Entrepreneurial State’s list of the most active CVC TOP50 in China in 2021 was released.

After more than 20 years’ development, CVC plays an increasingly important role in the venture capital market in China.At present, the domestic CVC market has begun to take shape, with more than 800 institutions, and the number of investment cases accounts for nearly 20% of the total venture capital market every year.It has become an indispensable backbone of China’s capital market.

Head enterprises such as BAT, Lenovo, Xiaomi and Huawei have gradually established their own corporate investment departments or investment subsidiaries, providing assistance for the company to lay out its future strategy, explore cutting-edge technologies and establish an ecological chain through CVC investment.

The proportion of CVC investment cases to the total VC investment cases hovers between 17% and 21%. In 2021, the value was 19.8%, a slight increase of 0.9% compared with 2020. At a time when asset prices are at a low point,CVC can give full play to its own capital advantages, find and identify high-quality projects with strategic vision, and help the strategic development of the parent company.

According to the data of Rui beast analysis, in 2021, the number of cases in which CVC institutions participated in investment in China venture capital market totaled 1,694, an increase of 20.4% compared with 2020. According to the data of the past five years, the number of investment cases of CVC institutions has dropped from 2,532 in 2017 to 1,694 in 2021, with an average annual decrease of 6.2%. However, in the past two years, CVC investment has continued to pick up.

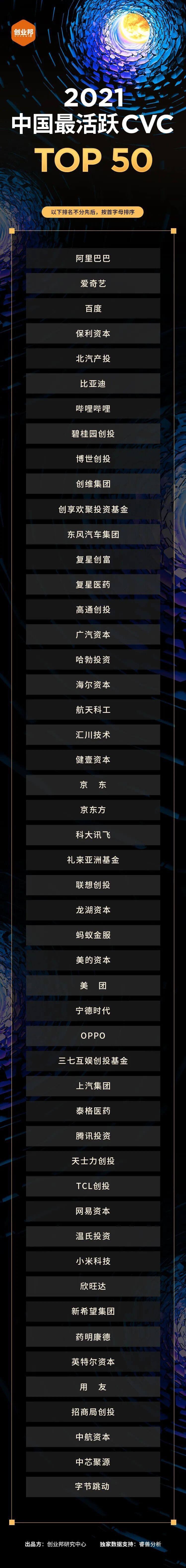

Since the selection was launched in April, 2022, the Entrepreneurship Research Center has selected the most active CVC TOP 50 in China in 2021 based on strict standards and rigorous data, with the principles of objectivity and fairness, by combining the analysis data of Rui beast, open market data and investigation interviews.

2021 China’s most active CVC TOP 50

Interpretation of CVC list

-

Parent company industries: concentrated in intelligent manufacturing, Internet, medical and health care and automobile transportation.

According to the data of Rui beast analysis, in 2021, 50 listed CVC institutions invested 1305 cases, and the average number of investment cases per institution was about 26. Among them, the number of CVC institutional investment cases in which the parent company is in the intelligent manufacturing industry is 304, accounting for 23.3%; There are 503 CVC institutional investment cases in which the parent company is in the Internet industry, accounting for 38.5%.

The parent companies of listed CVC institutions are mainly located in intelligent manufacturing, Internet, medical health and automobile transportation. Among them, the parent companies are typical CVC institutions in the intelligent manufacturing industry, including Lenovo Venture Capital and TCL Venture Capital. The parent companies of CVC institutions come from the Internet industry, with typical representatives including Tencent Investment, ByteDance and Alibaba, followed by medical health and automobile transportation, with a total of 12 institutions, such as (Sinopharm) Jianyi Capital, Tiger Medicine, BAIC Investment and GAC Capital.

With the goal of "double carbon" put forward, China has entered a new stage of green economy transformation. Developing new energy vehicles can not only optimize the energy structure, but also promote the economy because of its long industrial chain, wide coverage and many related industries. Enterprises reach the relevant industrial chain of new energy vehicles through CVC investment.

-

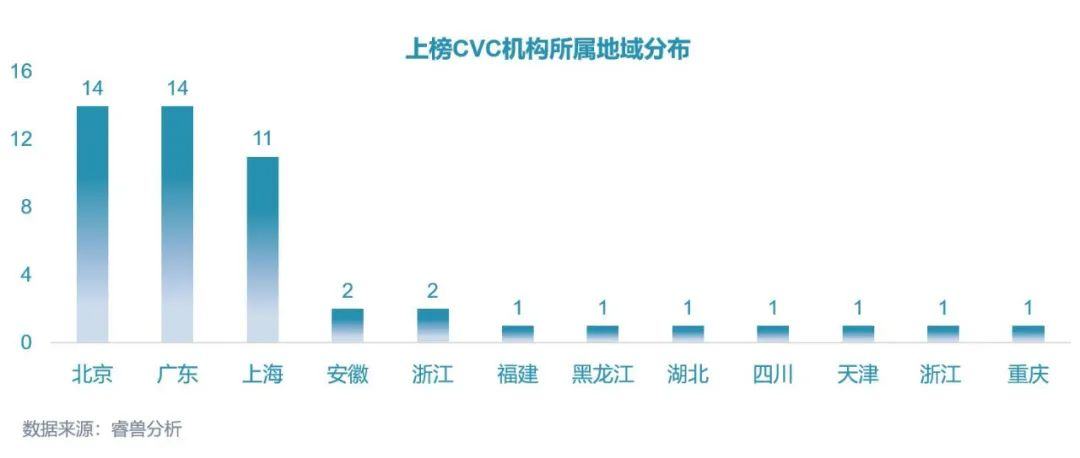

Geographical distribution: Beishangguang is still the gathering place of CVC institutions.

Judging from the geographical distribution of the listed CVC institutions, the top three are Beijing, Guangdong and Shanghai, and the number of CVC institutions accounts for 78%. Due to factors such as entrepreneurial ecology, capital accumulation and industrial effects, nearly 80% of the listed CVC institutions are gathered in Beishangguang, and first-tier cities continue to play a leading role in the entrepreneurial tide.

-

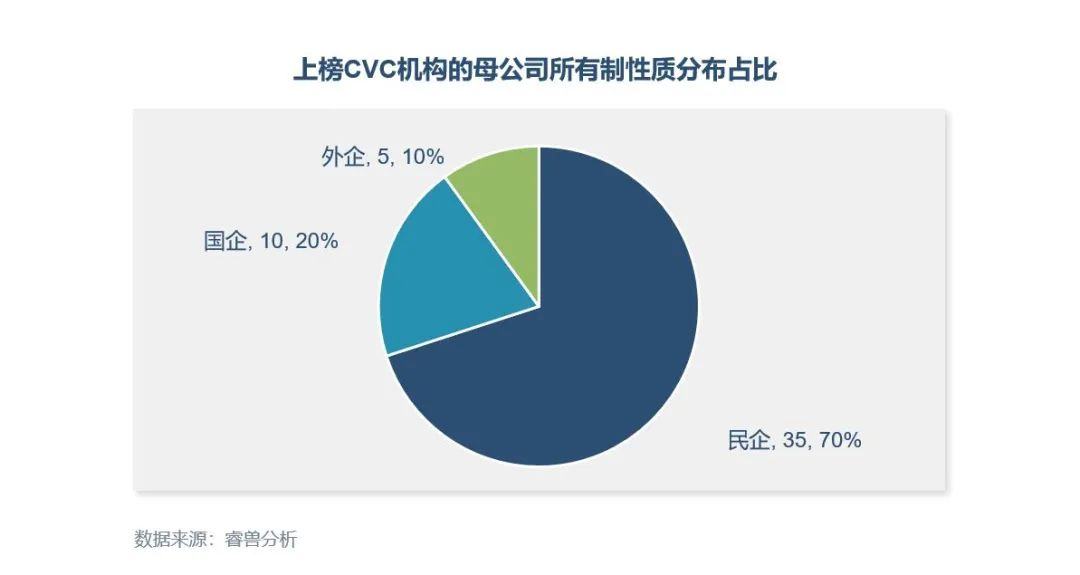

Nature of parent company: CVC institutions with private enterprise background are mostly.

Judging from the nature of the parent company ownership of the listed CVC institutions, there are 35 institutions with private enterprise background, accounting for 70%; There are 10 institutions with the background of state-owned enterprises, accounting for 20%; There are five institutions with foreign investment background, accounting for 10%, namely Lilly Asia Fund, Qualcomm Venture Capital, Intel Capital, Bosch Venture Capital and Pernod Ricard Chuangxiang Huanju Investment Fund. Most of the parent companies of the listed CVC institutions are private enterprises, indicating that CVC institutions with private enterprises are the main force.

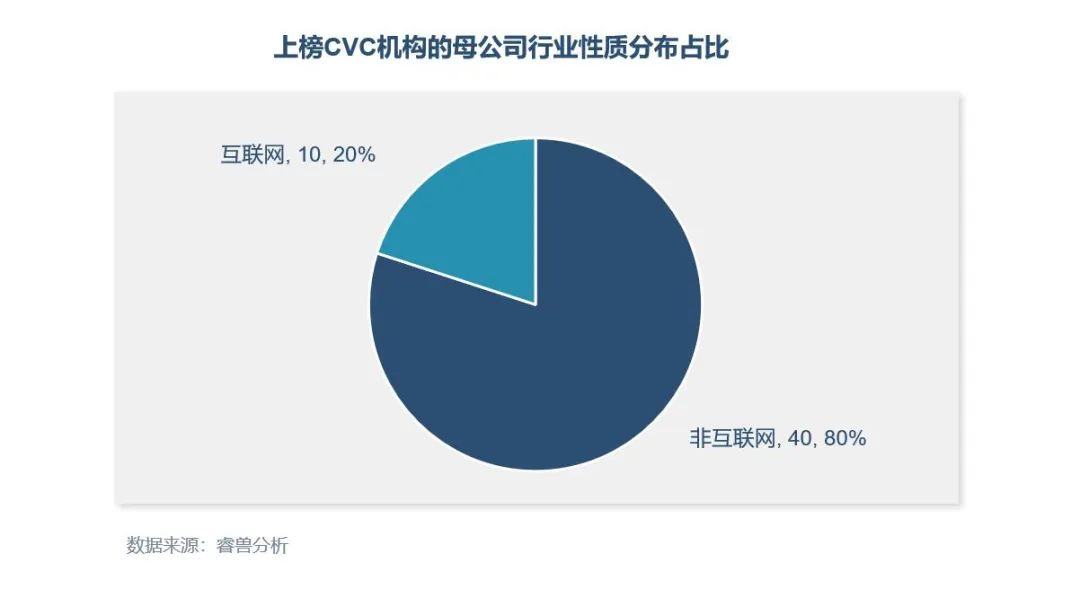

Among the listed CVC institutions, the parent companies of 10 institutions are from the Internet industry, with typical representatives including Tencent Investment, ByteDance and Alibaba, and the parent companies of 40 institutions are from strategic emerging industries strongly supported by the state and traditional non-Internet industries, such as BAIC Investment, GAC Capital, (Sinopharm) Jianyi Capital and Tiger Medicine.

-

Track distribution of investment industry: mainly concentrated in corporate services, culture and entertainment and medical health.

There were 1,305 major investment cases of CVC institutions in 2021, including 510 in corporate services, culture, entertainment and medical health, accounting for 39%. Tencent invested mainly in corporate services and culture and entertainment, with 85 and 47 investments respectively in 2021; Under the continuous influence of the epidemic, medical health has once again become a favored industry for CVC institutions.

-

Distribution of TOP3 CVC institutions in active industry tracks

The listed CVC institutions invested heavily in five tracks in 2021, namely enterprise services, culture and entertainment, medical health, intelligent manufacturing and artificial intelligence. Tencent Investment, Xiaomi Technology, Lenovo Venture Capital, etc. have invested in multiple tracks and are active in many fields such as corporate services, culture and entertainment, intelligent manufacturing, and artificial intelligence. Some CVC institutions focus on the main business direction of the parent company, Lilly Asia Fund focuses on the medical and health industry, and SMIC Juyuan focuses on the chip semiconductor industry.

For more details and data analysis, please visit https://www.cyzone.cn/report/, official website, the entrepreneurial state, to obtain the full CVC report "CVC Development Research Report of Venture Capital in China in 2021".