As of 20: 00 on January 24th, there were 2 new cases of pneumonia infected by novel coronavirus in Beijing, with a total of 36 cases.

From 17: 00 to 20: 00 on January 24th, two new cases of pneumonia infected by novel coronavirus were reported in Beijing, both of which had a history of contact with Hubei. They were diagnosed by CDC and expert group evaluation, and they were sent to designated medical institutions for treatment.

Prevention and control measures

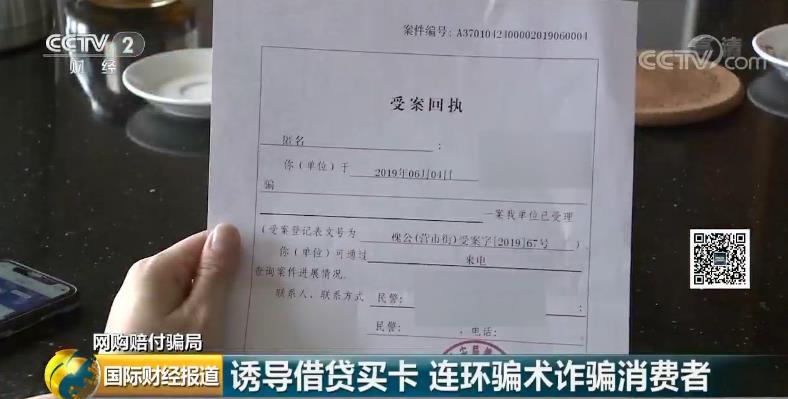

The State Council: Delaying reporting, misreporting and underreporting of the epidemic will be dealt with seriously.

On the 24th, the General Office of the State Council collected clues from the society on the platform of "internet plus Supervision" in the State Council, such as inadequate implementation of responsibilities, ineffective prevention and control, buck-passing, perfunctory and other issues, as well as opinions and suggestions on improving and strengthening prevention and control work.

The General Office of the State Council will summarize the clues and suggestions received, and urge relevant localities and departments to deal with them in a timely manner. The supervision office of the General Office of the State Council will directly send personnel to supervise the important clues related to delaying reporting, concealing or omitting reporting the epidemic situation and ineffective implementation of prevention and control measures, which will lead to serious consequences such as the spread of the epidemic situation. If it is verified, it will be dealt with seriously according to the law.

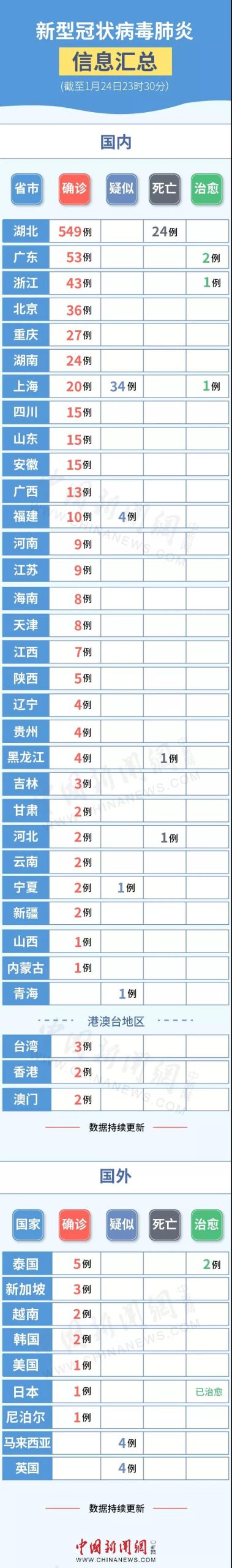

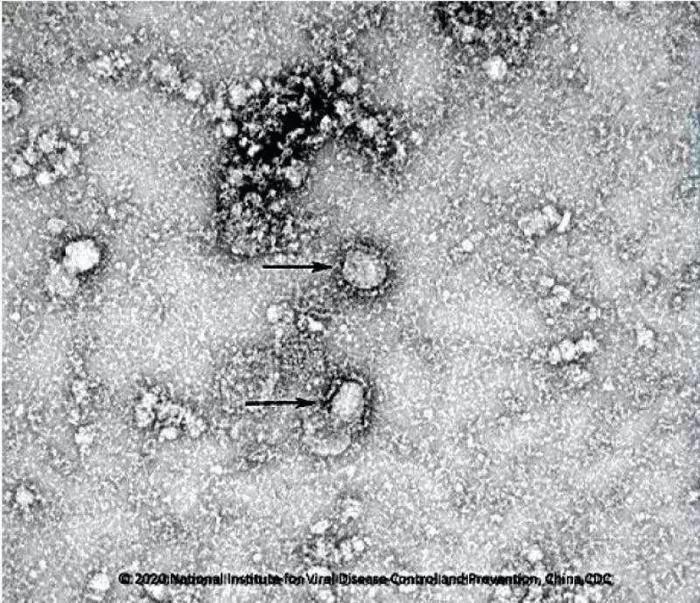

Information release of the first strain of novel coronavirus virus

On 24th, the National Pathogenic Microorganism Resource Database released the information of the first virus strain in China, its electron microscope photos, novel coronavirus nucleic acid detection primers and probe sequences, which were successfully separated by the Institute of Viral Disease Prevention and Control of China Center for Disease Control and Prevention, and provided sharing services.

Many provinces launched the first-level response mechanism for major public health emergencies.

As of 16: 00 on January 24, Hubei, Beijing, Shanghai, Anhui, Guangdong, Tianjin, Chongqing, Sichuan, Yunnan, Jiangxi and other provinces have launched the first-level response mechanism for major public health emergencies.

网页截图

The expert group of new pneumonia scientific research was established with Zhong Nanshan as the team leader.

On the 24th, the Ministry of Science and Technology of China announced through its official WeChat WeChat official account that it had jointly carried out emergency scientific research on the pneumonia epidemic in novel coronavirus with relevant departments, and set up an expert group for scientific research on the joint prevention and control mechanism of pneumonia epidemic in novel coronavirus, with Academician Zhong Nanshan as the team leader.

![<a target='_blank' href='http://www.chinanews.com/'>中新社</a>记者 苏丹 摄” src=”http://i2.chinanews.com/simg/cmshd/2020/01/25/9690cd72b3d64758a389ddf6721893df.jpg” style=”border:px solid #000000″ title=”<a target='_blank' href='http://www.chinanews.com/'>中新社</a>记者 苏丹 摄” /></div>

<div class=]()

China News Service reporter Sultan photo

Ministry of Human Resources and Social Security: Enterprises with production difficulties caused by the epidemic should try not to lay off employees or lay off fewer employees.

Ministry of Human Resources and Social Security issued a notice on the 24th, saying that if enterprises are in difficulties in production and operation due to the epidemic, they can stabilize their jobs by adjusting their salaries, rotating their posts and taking breaks, shortening working hours and so on through consultation with employees, and try not to lay off employees or reduce them as much as possible.

All localities have sealed off and isolated bamboo rats and other wild animals that may carry novel coronavirus.

The General Administration of Market Supervision, the Ministry of Agriculture and Rural Affairs and the National Forestry and Grassland Administration jointly issued a notice, requiring all localities to seal off and control the wild animals that may carry novel coronavirus, such as bamboo rats and badgers, in their breeding places, and it is strictly forbidden to spread abroad and prohibit transshipment and trafficking.

CAAC further upgraded prevention and control measures to prevent the epidemic from spreading through air channels.

On January 24, the Civil Aviation Administration held a special video conference, requiring all civil aviation units to closely follow the development and changes of the epidemic, take necessary measures and means such as temperature detection of passengers, and focus on prevention and control of key areas and key flights to prevent the epidemic from spreading through air channels. At the same time, it is necessary to ensure the smooth transportation channels for epidemic prevention and control materials and prevention and control personnel. In the special period of epidemic prevention and control, all transport airlines can reduce flights according to the development and changes of the epidemic.

The meeting stressed that all civil aviation units should further strengthen the protection of civil aviation employees’ own safety, and all personnel in direct contact with passengers and those working in crowded places should wear personal protective equipment such as masks; Strengthen the disinfection of public places such as terminal buildings and aircraft.

From January 25th, Beijing Capital International Airport and Beijing Daxing International Airport will carry out temperature tests on all passengers arriving in Beijing.

State-owned Assets Supervision and Administration Commission: Central enterprises involved in medicine actively develop antiserum and vaccine for novel coronavirus.

The Party Committee of the State-owned Assets Supervision and Administration Commission (SASAC) issued an urgent notice on January 22nd, demanding that the central enterprises take active actions and do their best to prevent and control the epidemic. The circular stressed that central enterprises involved in pharmaceutical research and production should speed up research and development and arrange production, and do a good job in health care. We should actively do a good job in the production and storage of virus detection reagents and related medical materials, arrange production tasks well under the premise of ensuring quality and safety, speed up the batch issuance and production progress, and ensure sufficient reserves. At the same time, under the leadership of relevant departments, actively carry out the development of antiserum and vaccine in novel coronavirus.

State administration of traditional chinese medicine: Establish a prevention and control mechanism of complementary advantages of Chinese and Western medicine

State administration of traditional chinese medicine held a video conference on the prevention and control of pneumonia in novel coronavirus in Beijing, deployed the prevention and control of pneumonia in novel coronavirus around the situation and tasks of joint prevention and control, and proposed to establish a prevention and control mechanism with complementary advantages of Chinese and Western medicine.

The army deployed joint prevention and control work to deal with public health emergencies.

In the early stage, the army has organized the military hospital in Wuhan to send 40 medical staff to the intensive care unit in pulmonary hospital, Wuhan.

图为佩戴口罩的民众在海口美兰国际机场到达厅迎接亲友。 骆云飞 摄

Severely crack down on the act of driving up the prices of commodities involved in the epidemic.

Affected by the pneumonia epidemic in novel coronavirus, masks, alcohol, disinfectant and other epidemic-related supplies are out of stock in some areas of China, and some products have greatly increased their prices. Local market supervision departments have intensively cracked down on the act of driving up the prices of commodities involved in the epidemic.

Wuhan Institute of Virology, Chinese Academy of Sciences issued a document saying that novel coronavirus came from bats.

China Academy of Sciences official WeChat "Voice of Chinese Academy of Sciences" released a message on 24th, saying that on January 23rd, Shi Zhengli’s team of Wuhan Institute of Virology of Chinese Academy of Sciences published an article on bioRxiv preprint platform, pointing out that novel coronavirus nCoV-2019 in Wuhan may have originated from bats.

截图

Wuhan:

-Wuhan Xiaotangshan Hospital is named Huoshenshan Hospital, which can accommodate 1,000 beds.

On the afternoon of January 23rd, Wuhan Urban Construction Bureau urgently convened the China Construction Third Bureau and other units to hold a special meeting, demanding that a special hospital, Wuhan Caidian Huoshenshan Hospital, be built in Wuhan Staff Sanatorium to treat novel coronavirus patients in a centralized way according to the model of Beijing Xiaotangshan Hospital during the fight against SARS in 2003. The hospital has a building area of 25,000 square meters and can accommodate 1,000 beds. It is led by China Construction Third Bureau, with the participation of three enterprises including Wuhan Construction Engineering, Wuhan Municipal Administration and Hanyang Municipal Administration.

—— All staff in Wuhan investigate and classify patients with fever.

Arrange fever patients by category. Pneumonia patients who have been identified or highly suspected to be infected in novel coronavirus shall be responsible by the Municipal Health and Health Commission, and arrange vehicles to be sent to designated treatment points for treatment; Suspected fever patients are kept in the fever clinic for observation; If the fever is mild, it can not be determined as a suspected patient, and each district is responsible for taking it back to the designated place for isolation observation; It is determined that the pneumonia patients who are not infected by novel coronavirus will be sent home by each district for observation.

-fever and cough are not the only first symptoms of COVID-19.

On January 24th, People’s Hospital of Wuhan University issued the "upgraded version" of COVID-19’s patient identification "Attach great importance to the first symptoms of non-respiratory system-identification and protection of patients with new coronavirus pneumonia (2019-nCOV)", reminding medical staff and the public to be highly alert to the invisible source of infection with non-respiratory symptoms as the first symptoms, and fever and cough are not the only first symptoms of new pneumonia.

—— Wuhan river-crossing tunnel will be closed from 0: 00 on January 25th.

In order to reduce the flow of people and reduce the risk of infection, since 0: 00 on January 25, 2020, the river-crossing tunnel has been closed, and the bridge crossing the river within the Third Ring Road (including the Third Ring Road) has been monitored and controlled for body temperature. The cancellation time will be announced separately.

-6,000 taxis are urgently collected, and 3 to 5 taxis in each community are dispatched by the neighborhood committees.

In order to solve the problems of inconvenient travel at home, the city urgently collected 6,000 taxis and distributed them to the central city. Each community has 3-5 sets, which are uniformly dispatched and used by the community neighborhood committees. From noon on January 25th, 2020, they will provide free services for residents in the area. Community neighborhood committees provide free home services such as food delivery, food delivery and medicine delivery for residents with inconvenient life.

![<a target='_blank' href='http://www.chinanews.com/'>中新社</a>记者 郑子颜 摄” src=”http://i2.chinanews.com/simg/cmshd/2020/01/25/9f219a35df6b4dc2a3be99d13110effd.jpg” style=”border:px solid #000000″ title=”<a target='_blank' href='http://www.chinanews.com/'>中新社</a>记者 郑子颜 摄” /></div>

<div class=]()

China News Service reporter Zheng Ziyan photo

Hubei:

Ezhou: From 11: 20 on January 23, 2020, the railway station passage in Ezhou City was temporarily closed.

Shennongjia: All scenic spots will be closed from 16: 00 on the 23rd, and buses in the area will be stopped.

Xiantao: Before 17: 00 on January 23, all buses and ferries in the city, including rural passenger cars, were shut down; The temperature detection and screening points of the high-speed exits and railway stations in the city are all set in place.

Zhijiang: From 17: 00 on January 23rd, all intercity buses and rural passenger vehicles will stop running. Except supermarkets, hospitals, farmers’ markets, gas stations, baby shops and pharmacies, all other business places in the city will be closed and closed. The recovery time will be announced separately.

Qianjiang: From 22: 00 on January 23, 2020, all long-distance passenger lines, rural passenger lines, tourist chartered buses, urban buses, grave-sweeping bus lines and Wangguai Ferry in Qianjiang City were suspended.

Huanggang: From 24: 00 on January 23, 2020, the bus and long-distance passenger transport in Huanggang City were suspended; The subway station and the railway station leaving Huanggang city are temporarily closed.

Chibi: Since 0: 00 on January 24, 2020, chibi city’s urban public transport, rural passenger transport and provincial and county-level passenger transport have been suspended, and the recovery time will be announced separately.

Jingmen: Since 0: 00 on January 24, 2020, the operation of passenger transport in Jingmen city, customized passenger transport, chartered passenger transport and rural passenger transport has been suspended, and taxis from all over the country are not allowed to operate outside the local urban area. The recovery time will be announced separately.

Xianning: The intercity railway will be suspended from 0: 00 on January 24, 2020. Since 10: 00 am on January 24, 2020, all bus lines, class lines and tourist passenger transport in Xianning City have been suspended, and the recovery time will be announced separately.

Jingzhou: From 12: 00 on January 24, 2020, the passage from Jingzhou Railway Station to Jingzhou was temporarily closed; Before 17: 00 on January 24, all buses, road passenger trains, tourist chartered cars, rural passenger vehicles and ferry boats in the urban area were temporarily closed and stopped. The recovery time will be announced separately. The local government will take the lead in arranging special classes, and set up temperature detection points in railway stations, long-distance bus stations, passenger terminals, highways and other places as required, and implement 24-hour shifts.

Huangshi: From 10: 00 on January 24, the city’s road passenger transport was suspended. Close the city (including daye city and Yangxin County, the same below) road passenger stations; All road passenger lines in the city (including loading lines passing through Huangshi area), all tourist passenger chartered cars in the city, and all rural passenger lines in the city (including passenger lines for every village) are temporarily suspended; Temporarily close shangyao ferry terminal; Temporarily close the channel of Huangshi Yangtze River Highway Bridge of Provincial Highway 201. The city’s bus lines were temporarily suspended. The recovery time of relevant outage lines and facilities will be announced separately.

Tianmen: From 13: 00 on January 24, 2020, the city’s buses, ferries, docks, rural passenger transport and long-distance passenger transport will be suspended. Close the city’s highway import and export channels, including national and provincial roads, county and township roads and village roads, and all vehicles and personnel are prohibited from passing. The recovery time will be announced separately.

Xiaogan: Since 24: 00 on January 24, 2020, the operation of public transportation, line passenger transportation, rural passenger transportation, tourist chartered bus, rural passenger ferry and network car in Xiaogan City has been suspended. High-speed railway station, Metro Station and Railway Station are temporarily closed when they leave Xiaogan City. The city’s cruise taxis operate with single and double numbers (the tail number is singular, and they operate on a single day; The tail number is even, and it is operated on two days). During the control period, cruise taxis should post signs reminding passengers to "wear masks to ride" and go to designated places for disinfection once a day.

Shanghai Disneyland and Disney Town are temporarily closed.

In order to meet the needs of epidemic prevention and control, and ensure the health and safety of tourists and cast members, Shanghai Disney Resort will temporarily close Shanghai Disneyland, Disney Town (including Walt Disney Grand Theatre) and Xingyuan Park from January 25th, 2020. We will continue to maintain close monitoring and close communication with government departments, and we will inform you of the time to resume opening.

上海迪士尼乐园1月25日起暂时关闭 供图 摄

Chongqing: All public cultural sites are temporarily closed.

All public cultural places are temporarily closed and mass cultural activities are stopped; All A-level scenic spots and cruise ships are suspended; All commercial performances stopped; 5,824 Internet cafes and 4,180 song, dance, entertainment and game entertainment venues were suspended; Travel agencies and online travel companies suspend the operation of team travel, outbound travel and "air ticket+hotel" tourism products; Hotels above the star level suspend banquet activities.

Hundreds of scenic spots, parks and cultural venues in Beijing are temporarily closed.

According to incomplete statistics, as of 17: 00 on January 24, hundreds of parks, scenic spots, museums, art galleries, libraries, temples, churches, performance venues and temple fairs in Beijing have announced that they will close their doors and cancel their activities from New Year’s Eve, and the opening hours will be resumed until further notice.

Wildlife trading is prohibited throughout Guangdong.

The Office of the Leading Group for the Prevention and Control of novel coronavirus Epidemic in Guangdong Market Supervision issued a circular No.1, deciding to isolate the places where wild animals are raised and bred in the province, and it is strictly forbidden to trade wild animals and their products.

On January 24, Sanya, Hainan, tourists wore masks to strengthen protection. Photo by Wang Xiaobin

海南:彻查入琼车辆及人员

做好特定人员登记工作;彻查入琼车辆及人员;做好入户调查登记工作;取消海南省大型室内公众聚集性活动;加强网络舆情管控力度;协助卫生防疫部门做好管控工作;做好信息的汇总上报工作。

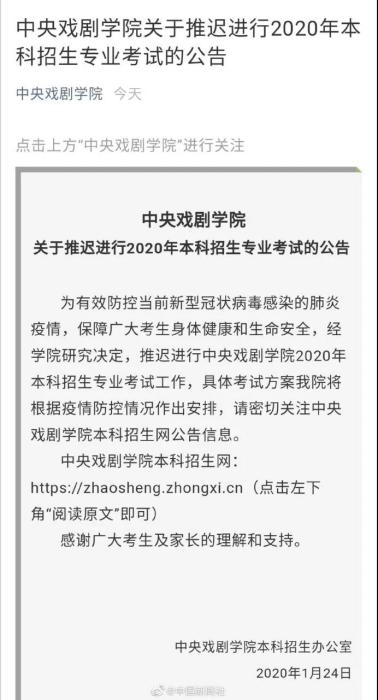

多所艺术类院校推迟本科招生专业考试

受不断变化的新型冠状病毒肺炎疫情影响,中央戏剧学院、上海戏剧学院、清华大学美术学院、中央美术学院、中国美术学院、上海大学、浙江传媒学院、武汉音乐学院等多所高校均发布公告,相继推迟今年艺考时间。

文字整理:李玉素